Chainlink: Contradicting the Market Sentiment with Fear & Greed – A Comprehensive Analysis

In the intricate world of cryptocurrencies, Chainlink has emerged as an interesting prospect. It is a decentralized oracle network designed to bridge the gap between smart contracts on the blockchain and real-world applications. This article will delve into the intricacies of our recent Chainlink price prediction, shedding light on the seemingly contradictory market sentiment and its implications for potential investors.

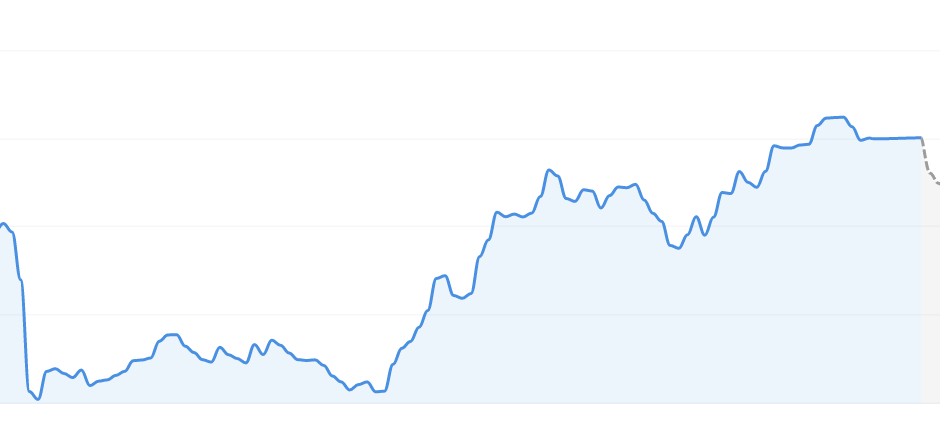

Based on our current prediction model, the value of Chainlink is expected to decrease by approximately -7.88%, falling to around $6.04 by July 10, 2023. It’s worth noting that this prediction relies on a set of technical indicators and historic market patterns. Nevertheless, the intrinsic volatility of cryptocurrencies often leads to considerable price fluctuations.

According to our technical indicators, the current market sentiment for Chainlink is bearish. This essentially means that there seems to be a trend favoring selling over buying, usually suggesting worries or a lack of confidence in the asset’s near-term performance. Factors contributing to a bearish sentiment can include broader market trends, regulatory news, or technological advancements, among others.

Paradoxically, the Fear & Greed Index for Chainlink currently stands at 61, which falls under the ‘Greed’ category. This presents an intriguing contradiction between the bearish sentiment and the high Fear & Greed Index, underlining the complex and often counterintuitive nature of the cryptocurrency market. A high Fear & Greed Index suggests that investors are primarily driven by potential high returns despite the inherent risks, which could also indicate a level of overconfidence that might precede a market correction.

Over the past month, Chainlink has recorded 17 green days out of 30, marking a positive trend for 57% of the time. A ‘green day’ in trading refers to a day when the price of the cryptocurrency has increased from the previous close. However, this positive performance comes against a backdrop of 8.37% price volatility over the past 30 days. While high volatility is a common characteristic in the cryptocurrency market, it serves as a stark reminder of the risk and unpredictability of these investments.

Taking these factors into account, our current Chainlink forecast suggests that this may not be an ideal time to invest in Chainlink. The anticipated decline in value, coupled with the prevailing bearish sentiment, seem to indicate potential pitfalls for new investments. However, it’s crucial to remember that in the ever-evolving cryptocurrency market, such predictions should be used as a guide, not an absolute truth.

For those with a belief in the long-term potential of Chainlink, this forecasted price drop could present a buying opportunity. The expected dip might offer a more enticing entry point for investors willing to brave the short-term volatility in the hopes of achieving long-term gains. Cryptocurrency history is filled with examples of major rebounds following significant price drops.

In conclusion, while the near-term forecast for Chainlink may look challenging, the long-term future of cryptocurrencies, including Chainlink, is subject to swift and often unforeseen changes. As with all investments, conducting thorough research, staying informed about market developments, and potentially seeking advice from financial professionals is vital. The key to navigating the tumultuous cryptocurrency market is to stay updated, understand the volatility, and adapt to changes as they occur. Investing in digital currencies may not be straightforward, but for those who can decipher its intricacies, the potential rewards can be substantial.